Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

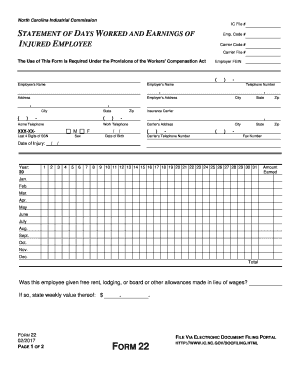

What information must be reported on north carolina statement?

In North Carolina, businesses must report information such as gross receipts, sales, and cost of goods sold on their income tax return. Businesses must also report any compensation paid to employees, the amount of taxes withheld from employee wages, and the cost of materials and services used in the business. Businesses are also required to report depreciation on property, any interest income earned, and any losses from the sale of property. Additionally, businesses must report any net operating losses and any credits from other states.

When is the deadline to file north carolina statement in 2023?

The deadline for filing a North Carolina tax return for the 2023 tax year is April 15th, 2024.

What is the penalty for the late filing of north carolina statement?

The penalty for late filing of a North Carolina Statement is a penalty of 5% of the unpaid tax per month, up to a maximum of 25%.

What is north carolina statement?

It is unclear what you mean by "North Carolina statement." North Carolina is a state in the United States, and it may have various statements or slogans associated with it. If you are referring to the state's official motto, it is "Esse quam videri," which means "To be, rather than to seem."

Who is required to file north carolina statement?

In North Carolina, individuals and businesses are required to file a North Carolina statement if they meet certain criteria. The specific requirements for filing a North Carolina statement vary depending on the type of entity.

Individuals: All North Carolina residents are required to file a North Carolina individual income tax return if they meet the income threshold set by the state. Non-residents who have income from North Carolina sources may also be required to file a North Carolina statement.

Businesses: Most businesses operating in North Carolina are required to file a North Carolina corporate income and franchise tax return. This includes corporations, limited liability companies (LLCs), partnerships, and sole proprietorships that meet certain thresholds.

It is important to consult the North Carolina Department of Revenue or a tax professional for specific requirements and thresholds for filing a North Carolina statement based on individual circumstances.

How to fill out north carolina statement?

To fill out a North Carolina statement, you will typically need to provide personal information, details of the incident or matter being addressed, and any additional supporting documents or evidence. The specific information required may vary depending on the type of statement or form you are completing. Here are general steps to help you through the process:

1. Obtain the correct form: Make sure you have the correct North Carolina statement form that corresponds to your specific situation. You can typically find the required form on the official website of the relevant North Carolina government agency or department.

2. Read and understand the instructions: Carefully review the instructions provided with the form to understand the purpose and requirements of the statement. Be aware of any specific guidelines or formatting instructions.

3. Personal information: Begin by providing your personal information, including your full name, address, phone number, and email address. Depending on the form, you may also need to provide your Social Security number or other identification details.

4. Case or incident details: Clearly state the purpose of your statement and provide all relevant details about the case or incident. Include dates, locations, names of involved parties, and any other necessary information.

5. Supporting documentation: Attach any supporting documents or evidence that may strengthen your statement. This could include photographs, witness statements, medical records, or any other relevant materials. Ensure that you make copies of all documents for your records before submitting them.

6. Affirmation and signature: Review the statement for accuracy and completeness. If required, provide an affirmation or a declaration that the information provided is true and accurate to the best of your knowledge. Sign and date the statement in the appropriate space.

7. Delivery: Follow the instructions on the form to submit the statement. You may need to mail it to a specific address or submit it online, depending on the requirements outlined.

Remember to keep a copy of the completed statement and all supporting documentation for your own records.

What is the purpose of north carolina statement?

The purpose of the North Carolina statement is to convey the vision, mission, values, and strategic goals of the state of North Carolina. It outlines the overall direction and aspirations for the state, serving as a guiding document for decision-making, policy development, and the allocation of resources. This statement often emphasizes the state's commitment to economic growth, sustainable development, education, healthcare, infrastructure improvement, and the well-being of its residents.

How can I send north carolina statement to be eSigned by others?

Once your what is form 2290 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit form 22 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your nc form 22 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my form 22 nc in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your north carolina notary statement form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.